Farmers should have access to sophisticated risk management tools to build a custom grain marketing strategy, which is why Tyson LGS has developed The FlexPrice™ Program for farmers. These flexible tools, used at your discretion, give you the ability to set your price and manage your exposure when you sell your grain to Tyson LGS.*

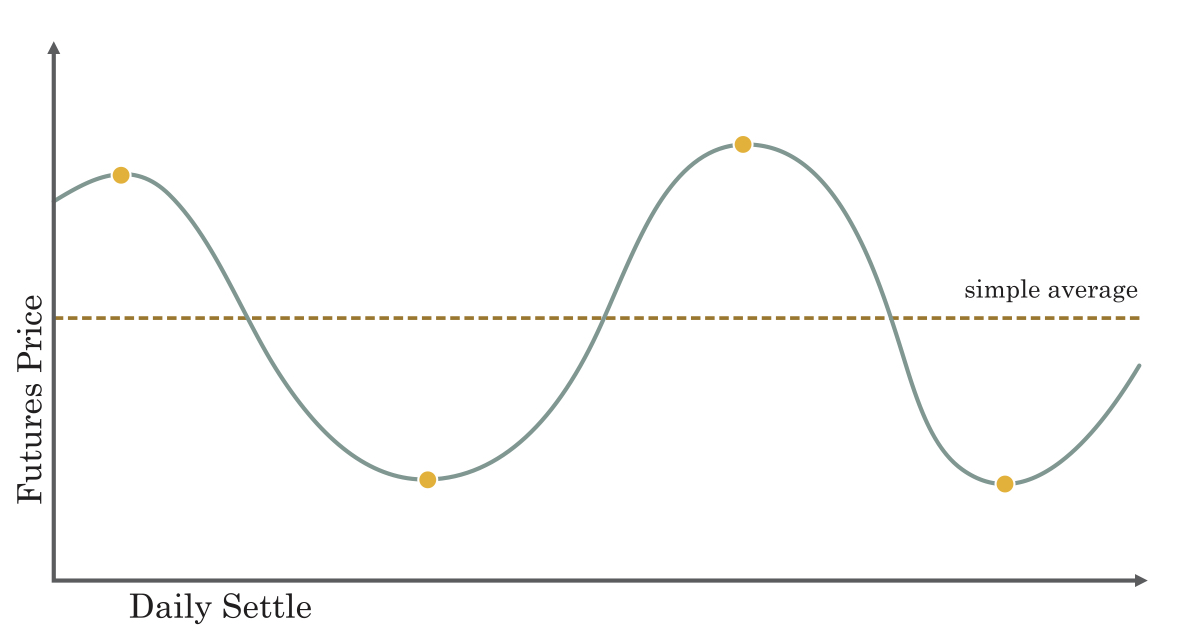

This tool allows you to select a time window to hedge your grain. Each day an equal portion of grain is priced. The final price for all bushels will be a simple average of each daily price for the specified time period.

*Price accelerator option allows you to price the total balance of your contract at any point in the defined pricing window.

-

Allows participant the ability to choose the time window to put in place their hedge against a falling market.

-

The final price will be the average of all daily settlements over the pricing period, creating a hedge that is reflective of the path of the market over this timeframe.

-

Price accelerator feature allows for flexibility to take advantage of market upside during the pricing period.

-

All committed bushels will be priced.

-

The final hedge is defined by the path of the market within the pricing window and will not reflect any further market movements beyond the conclusion of the window.

-

Closing the position prior to settlement will incur a cost defined by the present market and execution costs at that point in time.

Daily Bushels Sold = Total Number of Bushels/ number of good trading days in the pricing period.

- Participant sells daily bushels at the daily settlement value.

Simple average of all daily settlements is calculated to provide final hedge.

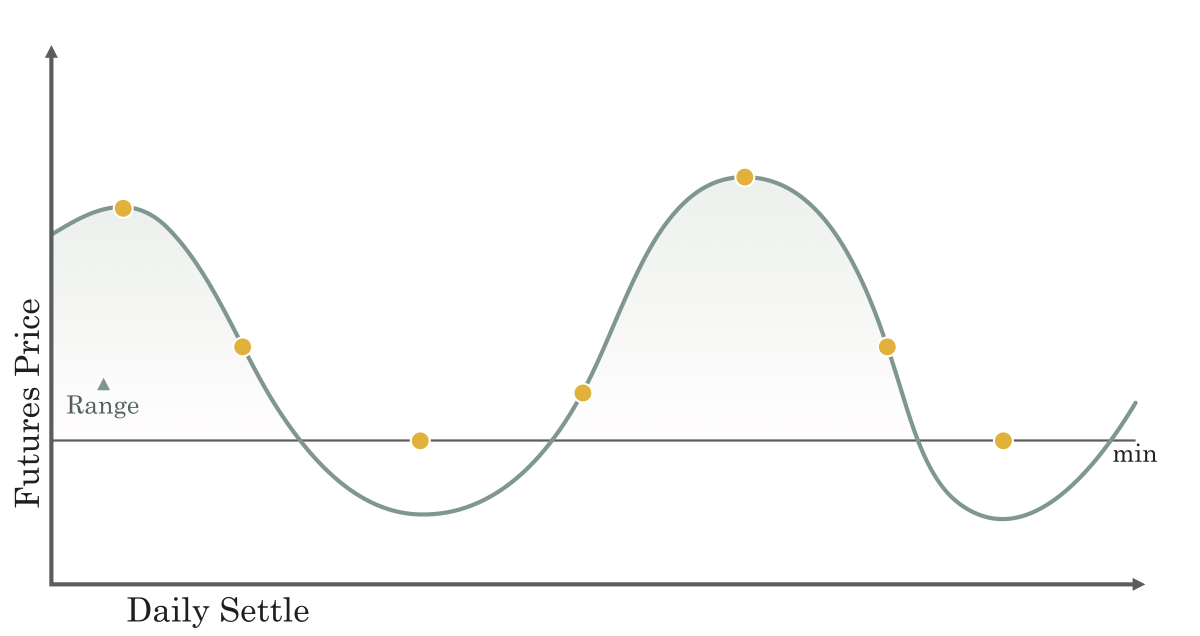

This tool allows you to select a minimum price for your hedge at the start of a defined pricing window. For a set premium, protection will be established against downside price movements below the minimum value, and will still allow for participation in price rallies. Each day an equal portion of grain is priced. If the price settles at or below the minimum price, the bushels price at the minimum for that day. If the price settles above that minimum value, the bushels price at the market settlement for that day. Final pricing is the simple average of each daily price for the specified time period.

-

Allows participant the ability to choose the minimum price for their structure to protect against a falling market.

-

The lower strike establishes a minimum price for the hedge.

-

Upside from the minimum price is unlimited.

-

The final price will be the average of all daily settlements over the pricing period, creating a hedge that is reflective of the path of the market over this time.

-

Price accelerator feature allows for flexibility to take advantage of market upside during the pricing period and price.

-

All committed bushels will be priced.

-

No double up or knock-out/in features.

-

There will be a fee associated with paying for the price minimum.

-

The final hedge is defined by the path of the market trades within the pricing window and will not reflect any further market movements beyond the conclusion of the window.

-

Closing the position prior to settlement will incur a cost defined by the present market and execution costs at that point in time.

Daily Bushels Sold = Total Number of Bushels/number of good trading days in the pricing period.

- Daily settlement <= minimum price = sell daily volume @ lower strike

- Daily settlement > minimum price = sell daily volume @ daily settlement

Average of all daily outcomes is calculated to provide final hedge.

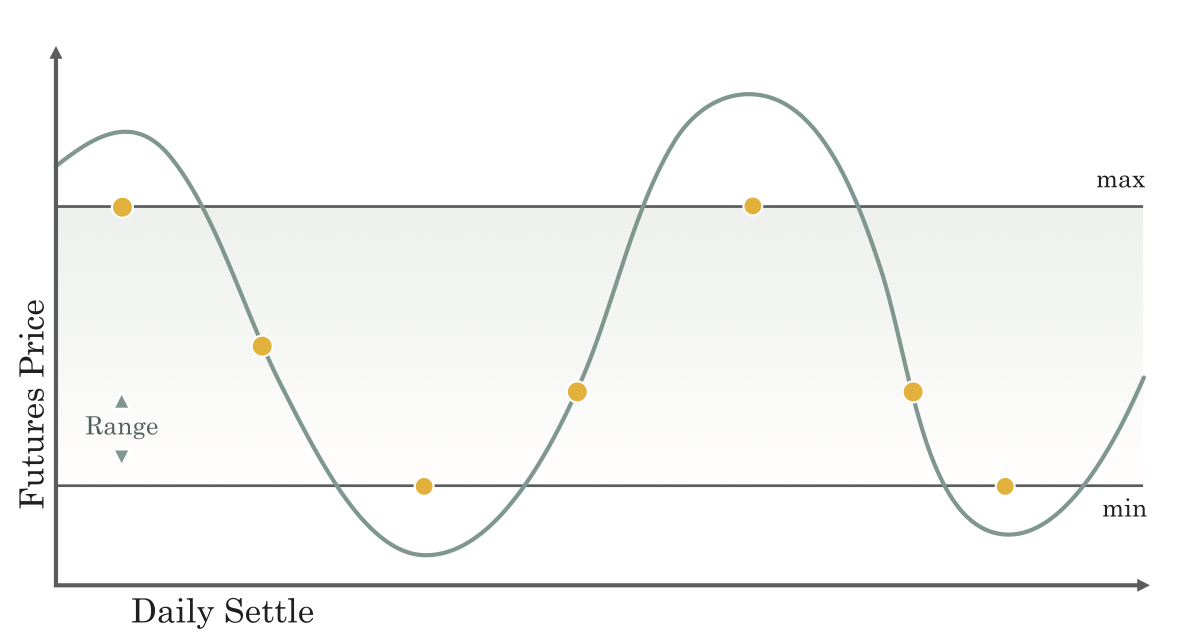

This tool allows you to select a minimum price and maximum price for your hedge at the start of a defined pricing window. Each day an equal portion of grain is priced. If the price settles at or above the max price, the bushels price at the maximum for that day. If the price settles at or below the minimum, the bushels price at the minimum for that day. If the price settles between those two values, the bushels price at the market settlement for that day. Final pricing is the simple average of each daily price for the specified time period. All bushels are guaranteed to price. Pricing period and futures contract reference are set before program start.

*Price accelerator option allows you to price the total balance of your contract at any point in the defined pricing window.

-

Allows participant the ability to choose the minimum and maximum price for their structure.

-

Setting a maximum price either reduces the cost to set a minimum price or creates a zero-cost structure where no additional fees are incurred.

-

The lower strike establishes a minimum price for the hedge.

-

The final price will be the average of all daily settlements over the pricing period.

-

Price accelerator feature allows for flexibility to take advantage of market upside during the pricing period and price.

-

All committed bushels will be priced.

-

Upside is capped at the maximum strike level.

-

The final hedge is defined by the path of the market trades within the pricing window and will not reflect any further market movements beyond the conclusion of the window.

-

Closing the position prior to settlement will incur a cost defined by the present market and execution costs at that point in time.

-

Daily Bushels Sold = Total Number of Bushels / number of good trading business days in the pricing period.

-

Daily settlement <= minimum price = sell daily volume @ lower strike

-

Daily settlement > minimum price < maximum price = sell daily volume @ daily settlement

-

Daily settlement > maximum strike = sell daily volume @ maximum price

Average of all daily outcomes is calculated to provide final hedge.

Floor

This tool allows you to select a floor for your grain price. For a set premium, protection will be established against downside price movements, with the ability to participate in upward price rallies.

-

Allows the participant the ability to choose the minimum price for their structure.

-

The lower strike establishes a minimum price (floor) for the hedge.

-

Upside from the minimum price is unlimited.

-

All committed bushels will be priced.

-

Upfront premium to enter into position.

- Closing the position prior to settlement will incur a cost defined by the present market and execution costs at that point in time.

-

Settlement < floor = difference between settlement and floor paid to participant

-

Settlement > floor = no outcome

Settlement occurs against the strike (floor) of the option and the closing price of the day of expiry for the contract.

Floor and Ceiling

This tool allows you to select a floor and ceiling for your grain price. All bushels will be priced no worse than the floor and no higher than the ceiling. This allows you to protect against downside and still participate in some upward price movements with a cheaper or zero cost premium to enter into the position.

-

Allows the participant the ability to choose the minimum and maximum price for their structure.

-

Setting a maximum price either reduces the cost to set a minimum price or creates a zero-cost structure where no additional fees are incurred.

-

The lower strike establishes a minimum price for the hedge.

-

All committed bushels will be priced.

-

Upside is capped at the maximum strike level.

-

Closing the position prior to settlement will incur a cost defined by the present market and execution costs at that point in time.

Daily Volume = Total Volume / number of good trading business days in the pricing period.

-

Settlement < floor = difference between settlement and floor paid to participant

-

Settlement > floor < ceiling = no outcome

-

Settlement > ceiling = difference between settlement and ceiling paid to Tyson

*Tyson LGS has created these tools but does not give advice or make decisions on behalf of the farmer. The farmer will work with the Tyson LGS risk manager to choose a tool offered in the FlexPrice™ Program and executed by a banking counterparty. Any use of a FlexPrice™ Program tool is chosen by the farmer.